39 zero coupon bond semi annual calculator

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Zero coupon bond semi annual calculator

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... Zero Coupon Bond Value Calculator - buyupside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Bond Convexity Calculator Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Yield to Maturity Calculator

Zero coupon bond semi annual calculator. › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Coupon Payment Calculator If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 Zero Coupon Bond: Formula & Examples - Study.com In order to calculate the ytm of zero-coupon bond, assuming a yearly discount rate, the following zero-coupon bond formula is used: ... If the bond matures in four years, then 4 * 2 semi-annual ... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. › loanLoan Calculator Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds. How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9/2,K5) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5. After executing the respective formulas, you can find different bond prices as depicted in the latter screenshot. Calculate Zero Coupon Bond Value - calculatoratoz.com Zero Coupon Bond Value = Face Value/ (1+Rate of Return/100)^Time to Maturity V = F/ (1+%RoR/100)^T This formula uses 4 Variables Variables Used Zero Coupon Bond Value - Zero Coupon Bond Value is referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments, and instead pays one lump sum at maturity.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. veux-veux-pas.fr › en › classified-adsAll classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. Bond Price Calculator F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Price of the bond = M / (1 + r) ^ n = 50 / (1+0.02) ^5 = $45.287 Therefore, $45.3 is the amount that Mr.Tee will pay for the bond today. Semi-Annual Compounding Bonds Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded semi-annually.

Zero Coupon Bond Calculator - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.

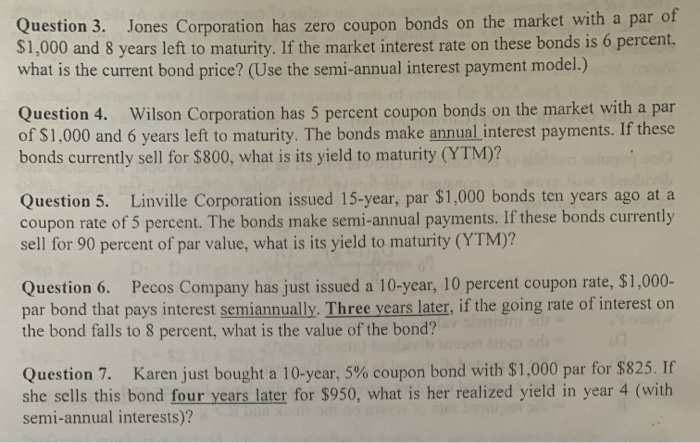

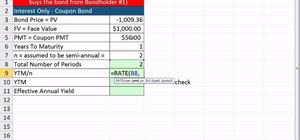

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

› knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

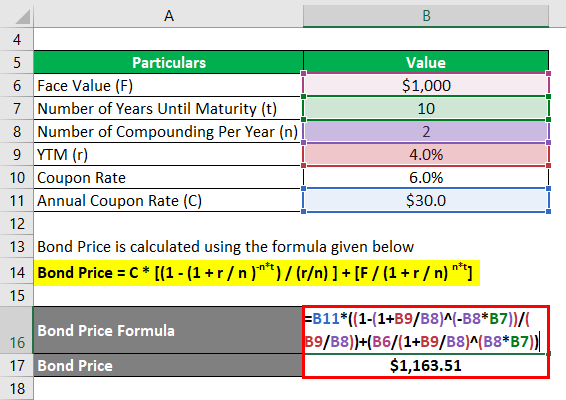

How to calculate bond price in Excel? - ExtendOffice In this condition, you can calculate the price of the semi-annual coupon bond as follows: Select the cell you will place the calculated price at, type the formula =PV (B20/2,B22,B19*B23/2,B19), and press the Enter key. Note: In above formula, B20 is the annual interest rate, B22 is the number of actual periods, B19*B23/2 gets the coupon, B19 is ...

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... In the example of a 5 percent bond - which has two 2.5 percent payments annually - with a four-year term, raise 1.025 to the power of negative 1 to calculate the discount factor for the first period.

Zero-Coupon Bond - Definition, How It Works, Formula Example 1: Annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53.

Consider the following bonds: a) 3-year zero coupon | Chegg.com Transcribed image text: Consider the following bonds: a) 3-year zero coupon bond with a face value of £100 (Bond A), b) a semi-annual 6% coupon bond with a face value of £100 and a maturity of 4 years (Bond B). c) a semi-annual 5% bond with a maturity of 2 years and a face value of £100 (Bond C). Assume that the required yield is 4% per annum across all maturities.

45 zero coupon bond semi annual calculator How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9...

› bond-yield-calculatorBond Yield Calculator - CalculateStuff.com In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond Price = current price of the bond. Face Value = amount paid to the bondholder at maturity. Coupon = periodic coupon payment.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

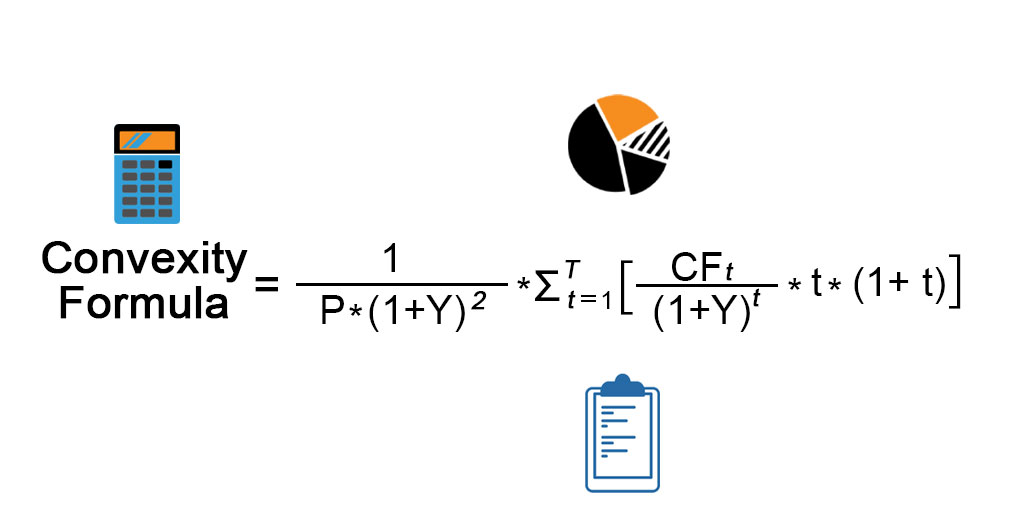

Zero Coupon Bond Value Calculator - buyupside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Bond Convexity Calculator Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Yield to Maturity Calculator

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Post a Comment for "39 zero coupon bond semi annual calculator"