41 coupon interest rate definition

Interest coupon Definition | Law Insider Interest coupon means: (d) with respect to Fixed Rate Bonds rate of interest on the Bonds expressed as a percentage rate pr. Annum as set out in the applicable Final Terms; and (e) with respect to Floating Rate Bonds the aggregate of the Reference Rate and the Interest Rate Spread, each as set out in the applicable Final Terms. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Junior Coupon Rate Schedule Definition | Law Insider Examples of Junior Coupon Rate Schedule in a sentence. Interest payments ("Junior Coupon Payments", and together with the Senior Coupon Payments, the "Coupon Payments") to the holders of the Junior Notes will (excluding the Junior Note Additional Interest referred to below) accrue on each Junior Note on a pro rata basis at the percentage rate per annum of the Junior Notional Amount applicable ...

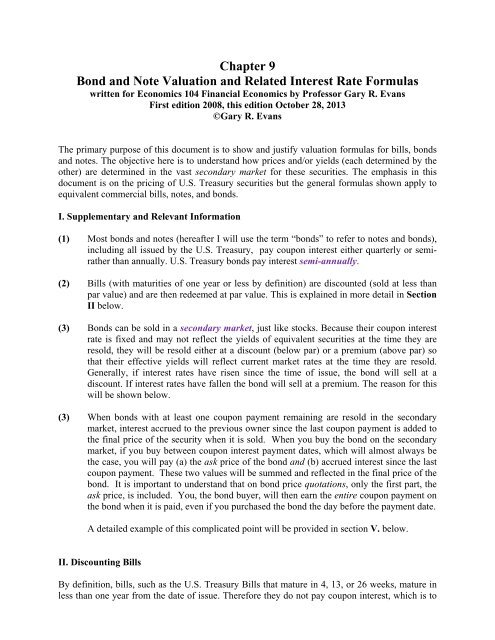

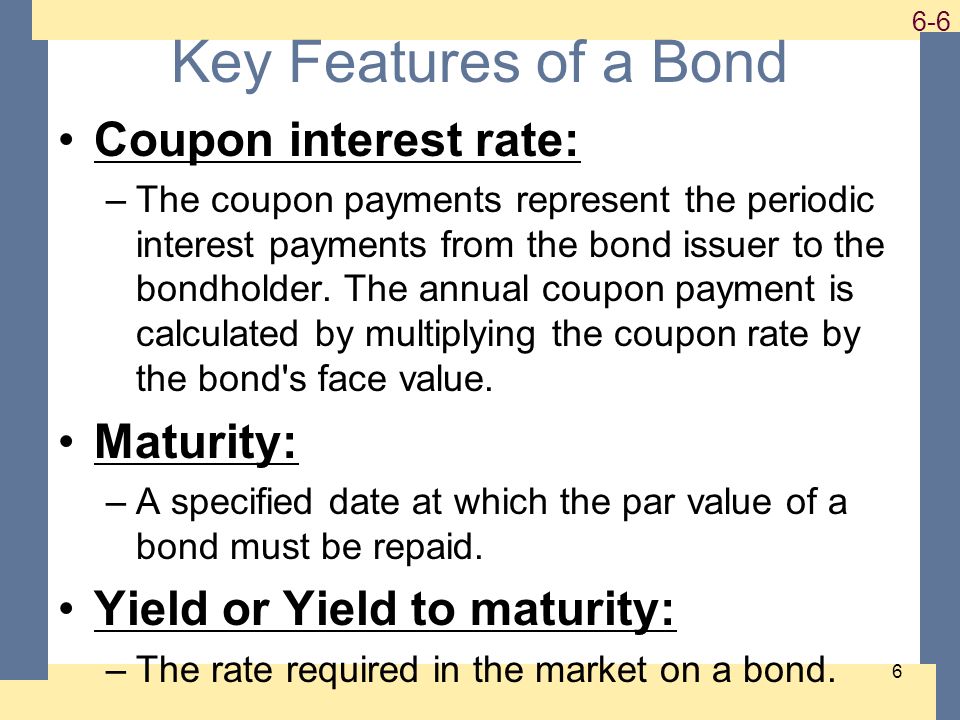

Coupon interest rate definition

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. In other words, there payments are the periodic payments of interest to the bondholders. Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

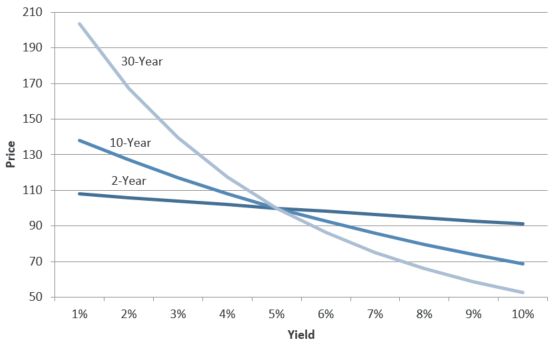

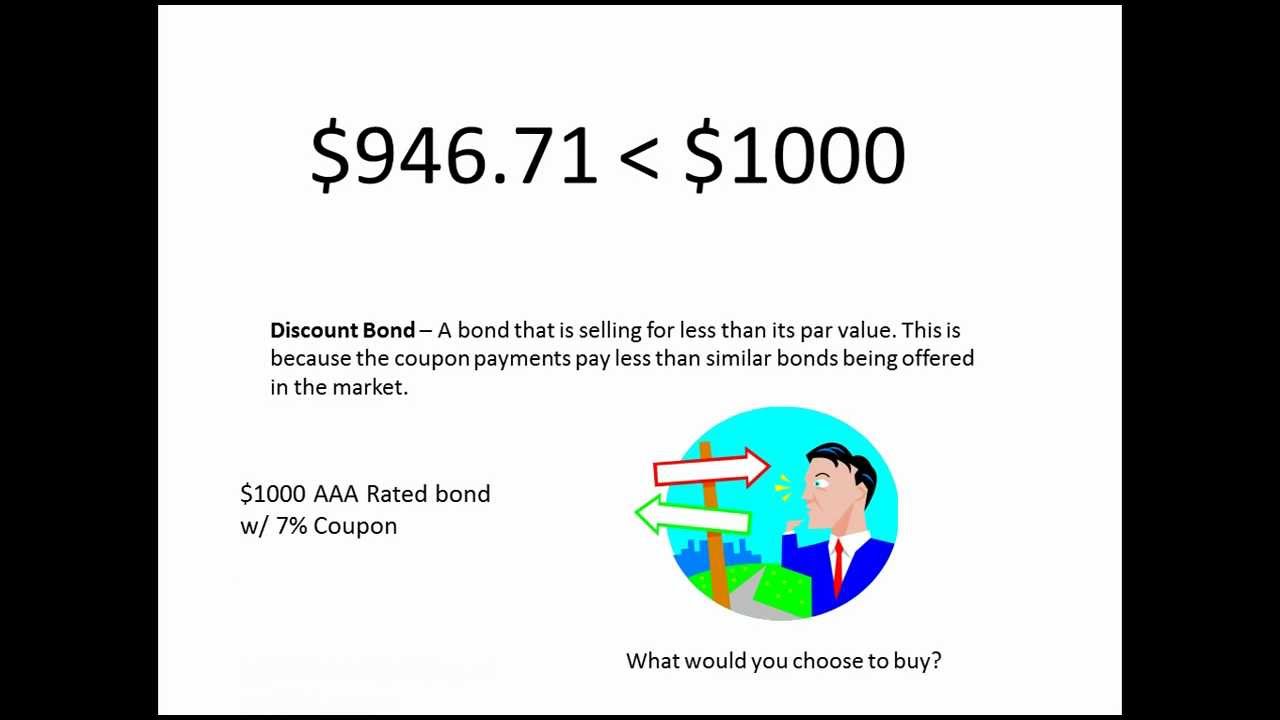

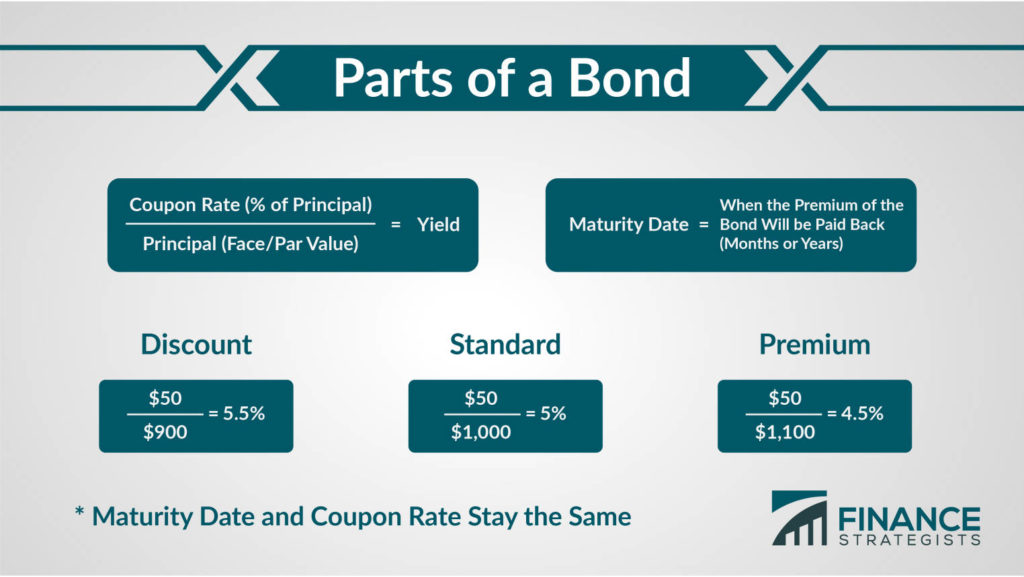

Coupon interest rate definition. Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ... Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. Variable Interest Rate Definition - Investopedia Mar 31, 2021 · Variable Interest Rate: A variable interest rate is an interest rate on a loan or security that fluctuates over time, because it is based on an underlying benchmark interest rate or index that ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

Interest rate - Wikipedia An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence. Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and … Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ...

Coupon Interest Rate: What is Coupon Interest Rate? Fixed Income ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi Coupon rate definition and meaning | Collins English Dictionary The coupon rate is the interest rate on a bond calculated on the number of coupons per year. A tax-exempt municipal bond has a higher after-tax yield than a ... Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence? Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate will typically be lower than the stated interest rate, which is also referred to as a nominal interest rate or nominal yield. What is the coupon rate? - Definition. The coupon rate is the annual interest rate that a bond pays. That may seem obvious, but it's important to remember: The coupon rate doesn't specify how much ...

Coupon Interest | Insurance Glossary Definition | IRMI.com Coupon Interest — the rate of interest paid to the holders of a bond. This rate can be either a floating variable or fixed rate. Often, zero coupon bonds are issued that pay no interest until the bond is redeemed to guarantee repayment of the principal of the bond or specific tranche.

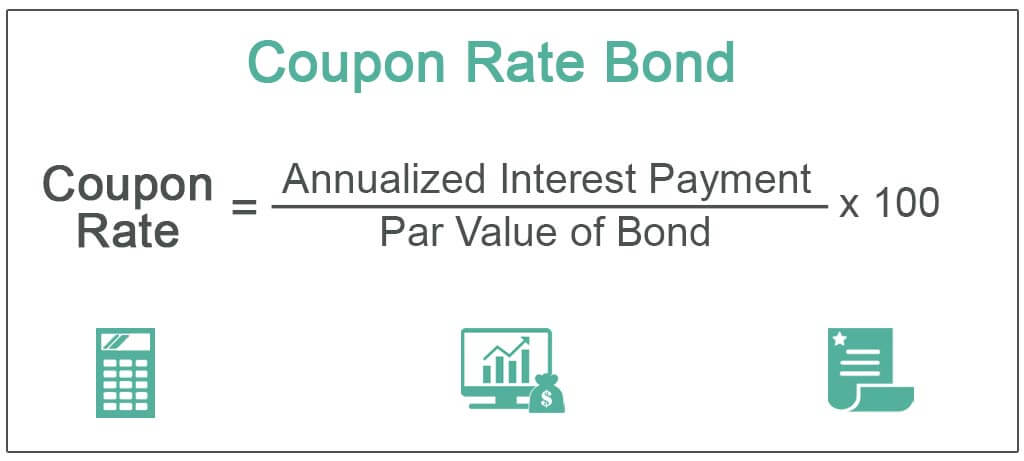

Learn About Coupon Interest Rates | Chegg.com The coupon interest rate indicates the annual interest rate paid by the issuer of the bond, taking into consideration its face value. The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond.

Difference Between Coupon Rate and Required Return Coupon Rate: Required Return: Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100

Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

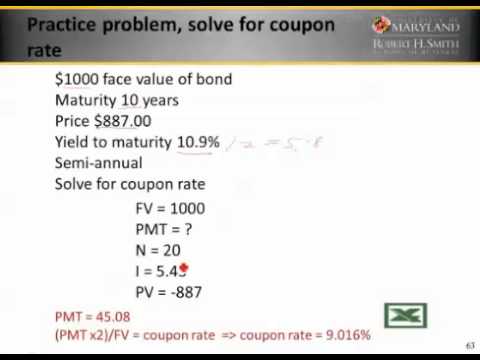

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual amount of interest that the owner of the bond will receive. To complicate things the coupon rate may also be referred to as the ...

What is Coupon Rate? Definition of ... - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

Interest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ...

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon rate, as used in fixed-income investing, refers to the annualized interest with respect to the initial loan amount. Learn the definition of and formula for coupon rate, and understand the ...

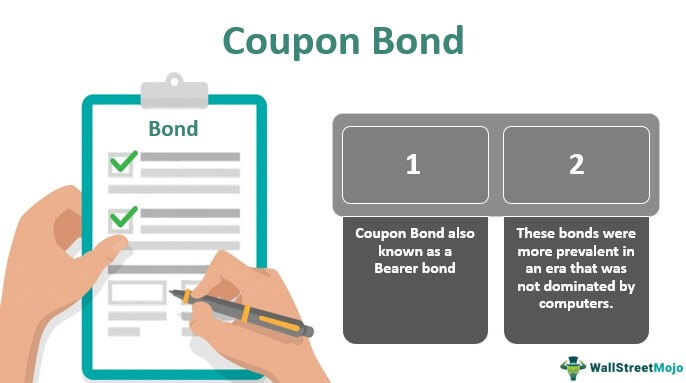

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Interest - Wikipedia In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate.

Coupon rate - definition and meaning - Market Business News A coupon rate is the interest rate that is paid on a bond (twice a year) that is stated when the bond is issued until it reaches maturity.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

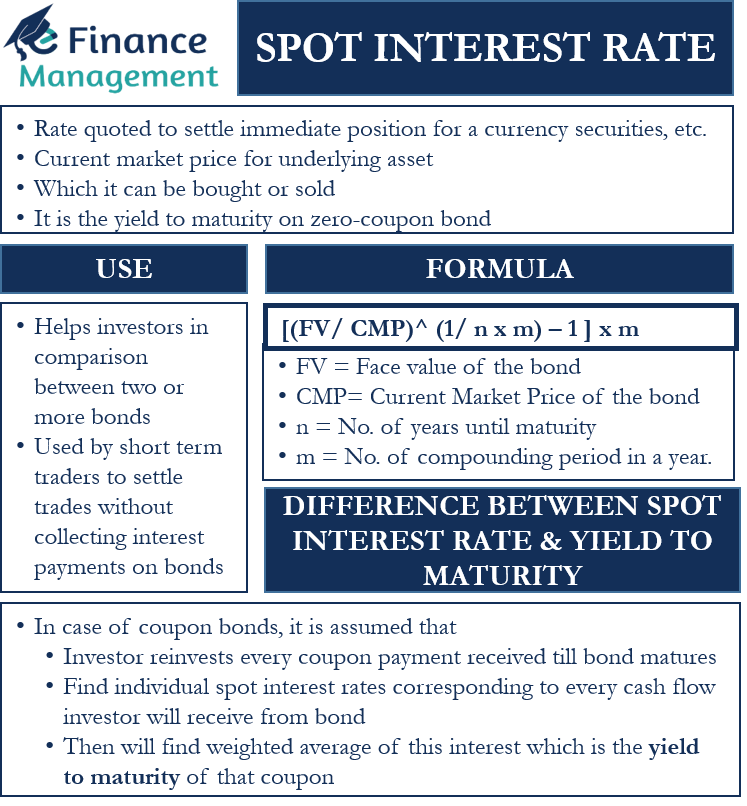

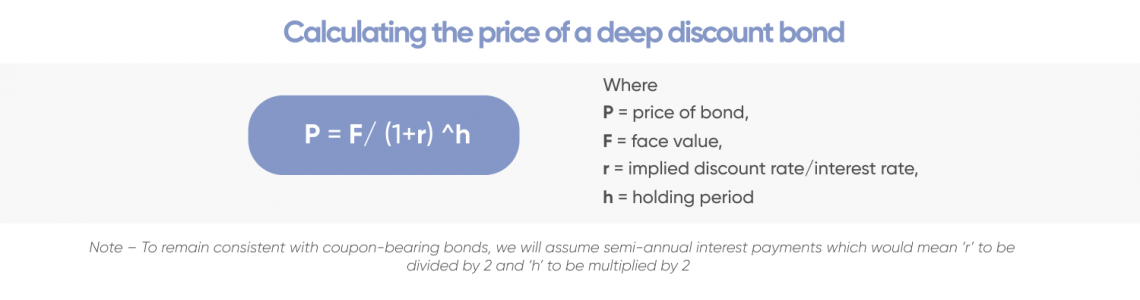

Spot Interest Rate: Meaning, Usage, Calculation, Examples The spot interest rate is the YTM or yield-to-maturity of such zero-coupon bonds. Therefore, in simple words, it is the rate of return that an investor can earn on bonds when he trades them at a particular point of time without collecting interest on them.

Difference Between Coupon Rate and Interest Rate The coupon rate is also known as the nominal rate. It is defined by the fixed interest secrets of the bondholder. The final amount will be received by the holder at the end of the maturity period. Additionally, the coupon rate will be stable till the bondholder receives his money. Readers who read this also read:

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon rate definition - AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Difference Between Coupon Rate and Interest Rate Coupon Rate is the yield that is being paid off for a fixed income security like bonds. This rate usually represents as an annual payment paid by the issuing party considering the face value or principal of the security. Issuer is the one who decides this rate.

Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. In other words, there payments are the periodic payments of interest to the bondholders.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 coupon interest rate definition"